-

GEP Software

-

- Procurement Software

- Direct Procurement Software

- Indirect Procurement Software

- Unified Source-to-Pay

- Source-To-Contract Software

- Procure-to-Pay

- Midsize & High Growth Enterprises

- Key Capabilities

- Spend Analysis

- Sourcing

- Contract Lifecycle Management

- Supplier Lifecycle Management

- Third-Party Risk Management

- Purchasing

- Payments

- Data Analytics and Reporting

- Do more with GEP SMART

- Intake Management & Orchestration

- Intelligent Category Management

- Tail Spend Management

- Cost Data & Analytics (GEP COSTDRIVERS)

- AI-First Supply Chain Management

- Supply Chain Visibility and Execution

- Logistics Visibility

- Inventory and Warehouse Management

- GEP Multienterprise Collaboration Network

- Supply Chain Control Tower

- Field Services

- Supply Chain Collaboration & Planning

- Supply Chain Planning

- Purchase Order Collaboration

- Forecast Collaboration

- Capacity Collaboration

- Quality Management Software

- Should-Cost Modeling

- Direct Material Sourcing

-

-

GEP Strategy

-

GEP Strategy

Unrivaled supply chain and procurement expertise + the transformative power of AI

Supply Chain Consulting

- Environmental, Social and Governance

- Sustainability Consulting Services

- Socially Responsible Sourcing

- Scope 3

- Demand and Supply Chain Planning

- Collaborative Planning

- Source To Contract

- Procure To Pay

- Inventory Strategy & Management

- Operations & Manufacturing Excellence

- GEP Total Inventory Management Solution

- Network Strategy & Optimization

- Warehousing & Transportation Management

-

-

GEP Managed Services

-

GEP Managed Services

World-class skills, experience and know-how — amplified by the power of AI

-

- U.S. factories cut back purchases sharply, signaling heightened risks of manufacturing weakness spilling over into the broader economy in 2025

- In contrast, Chinese factories report growth following three months of shrinking input purchasing

- Europe’s industrial recession shows no sign of abating, with German, French and Austrian producers at the heart of the downturn

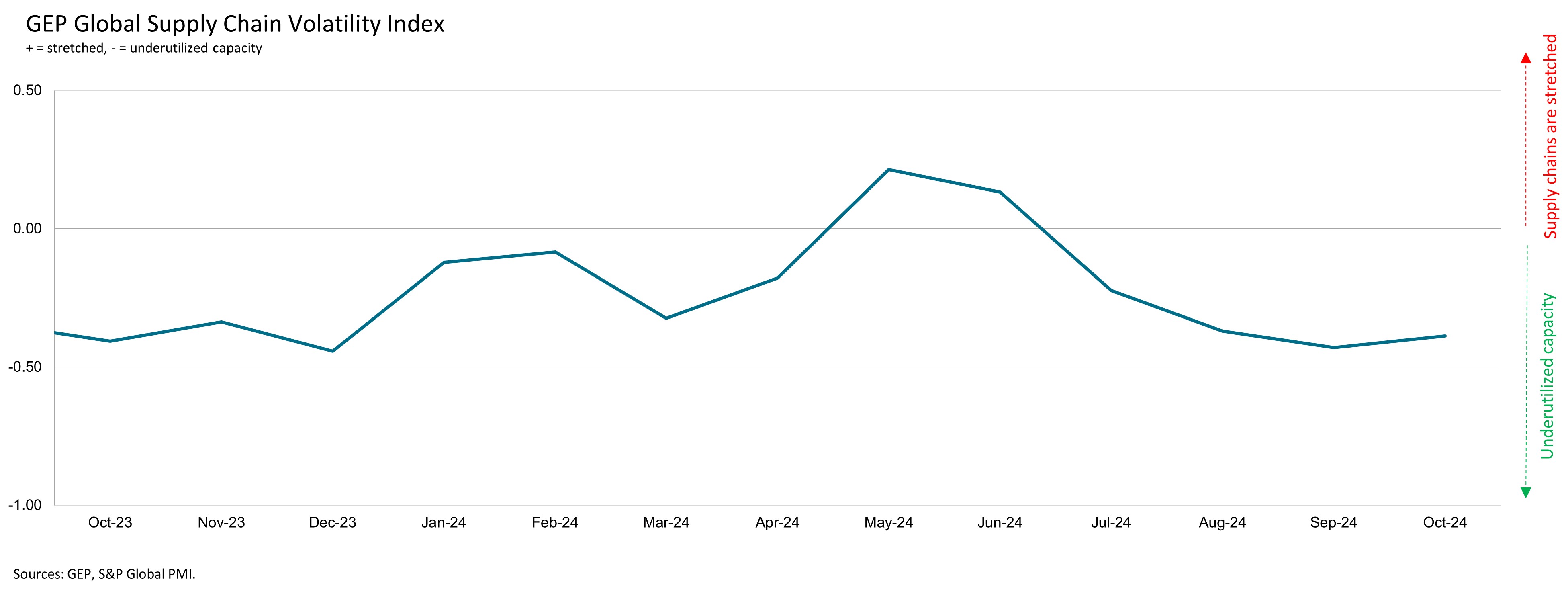

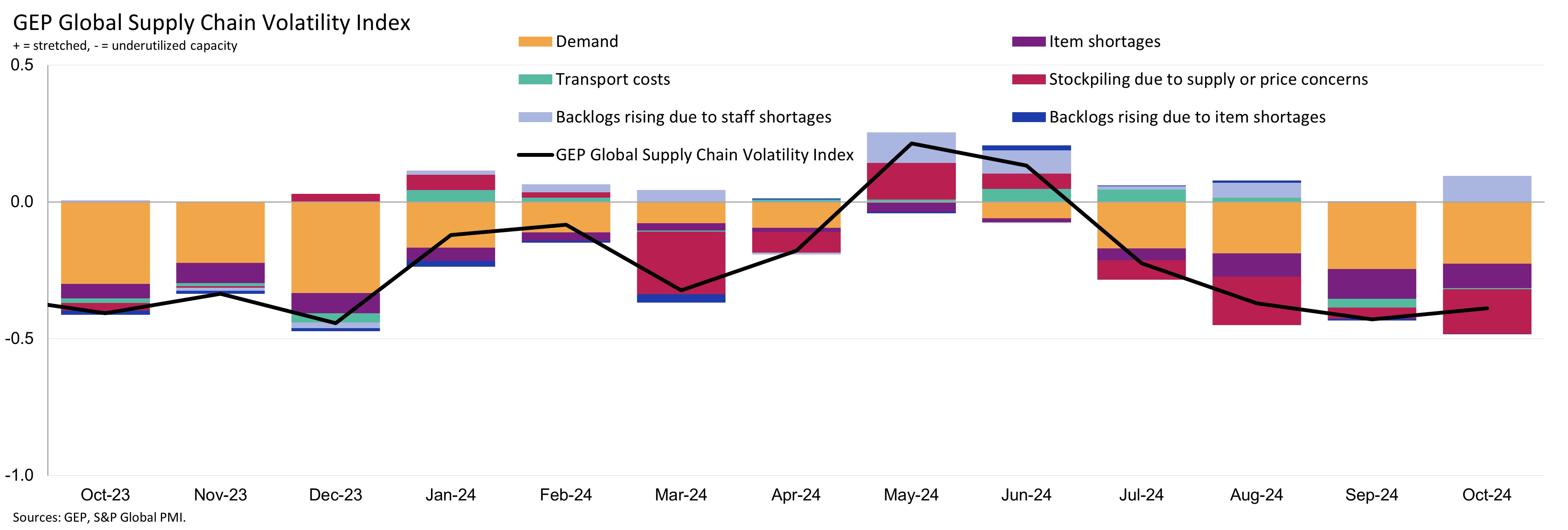

Clark, N.J., Nov. 12, 2024 – The GEP Global Supply Chain Volatility Index — a leading indicator tracking demand conditions, shortages, transportation costs, inventories and backlogs based on a monthly survey of 27,000 businesses — posted -0.39, which was little change from -0.43 in September. Therefore, the index remained in territory that indicated one of the highest levels of spare capacity at global suppliers in over a year during October, with no imminent turnaround in Western manufacturing in sight.

Suppliers feeding the world’s largest markets reported contractions in October. Most notable was another steep rise in slack across North American supply chains due to declining factory activity in the U.S. In fact, purchasing managers at U.S. manufacturers made their strongest cutbacks to buying volumes in nearly a year and a half, indicating that factories in the world’s largest economy are preparing for lower production volumes.

Suppliers feeding Asia also reported spare capacity in October, albeit to a lesser degree than we’re seeing in Western markets. This is due to the sustained strong expansion of certain manufacturing industries, such as India’s. Notably, in October, China’s factory production growth rebounded, and procurement activity rose after three months of contraction, although Japanese and South Korean producers made fewer purchases — an adverse leading indicator for manufacturing in these economies.

Europe’s industrial plight remained a key feature of the data in October. Vendor capacity was significantly underutilized, reflecting a continuation of subdued demand in key manufacturing hubs across the continent. Germany’s retrenching automotive manufacturing sector is a major headwind to factory output in Europe.

Additionally, October is the 14th consecutive month that the items in short supply indicator has been negative — an excess supply of commodities and intermediate goods relative to current manufacturing demand globally.

“We’re in a buyer's market. October is the fourth straight month that suppliers worldwide reported spare capacity, with notable contractions in factory demand across North America and Europe, underscoring the challenging outlook for Western manufacturers,” explained Todd Bremer, vice president, GEP. “President-elect Trump inherits U.S. manufacturers with plenty of spare capacity while in contrast, China’s modest rebound and strong expansion in India demonstrate greater resilience in Asia.”

Interpreting the data:

- Index > 0, supply chain capacity is being stretched. The further above 0, the more stretched supply chains are.

- Index < 0, supply chain capacity is being underutilized. The further below 0, the more underutilized supply chains are.

OCTOBER 2024 KEY FINDINGS

- DEMAND: Procurement activity remains weak across the globe. Demand for commodities, components and raw materials continues to contract, and at one of the steepest rates seen in 2024 so far. By region, North America that saw the weakest purchasing activity in October, followed by Europe. Input demand was more resilient in Asia, but still subdued overall.

- INVENTORIES: Inventory drawdowns intensified across factories worldwide in October. Reports of safety stockpiling remained low by historical standards as companies look to make their warehouses leaner to preserve cash flow and tightly manage stocks in line with the weak order situation.

- MATERIAL SHORTAGES: The items in short supply indicator, an aggregate measure which tracks the availability of critical components and raw materials, remains low, pointing to robust supply levels.

- LABOR SHORTAGES: Reports of manufacturers’ backlogs rising due to labor shortages ticked higher in October and were above the long-term average. However, factory employment levels have fallen in recent months, suggesting throughput has decreased as a result of lower workforce capacity and companies aren’t clearing backlogs as quickly.

- TRANSPORTATION: Global transportation costs were in line with their long-run average during October.

REGIONAL SUPPLY CHAIN VOLATILITY

- NORTH AMERICA: Index at -0.72, versus -0.78 previously. The latest figure is consistent with a substantial level of spare capacity at North America’s suppliers.

- EUROPE: Index at -0.52, from -0.74. Albeit an improvement from September, the latest data indicate a continuation of Europe’s industrial recession.

- U.K.: Index fell notably to -0.40, from -0.12, its lowest level in six months, signaling a deterioration in the U.K. manufacturing sector.

- ASIA: Index at -0.20, from -0.36. While indicative of spare capacity, the level of slack is much lower than seen in Western markets. India continues to have a strongly positive influence on the region.

For more information, visit www.gep.com/volatility

Note: Full historical data dating back to January 2005 is available for subscription. Please contact economics@spglobal.com.

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, Dec. 11, 2024.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global’s PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

- A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

- A value below 0 indicates that supply chain capacity is being underutilized, reducing supply chain volatility. The further below 0, the greater the extent to which capacity is being underutilized.

A Supply Chain Volatility Index is also published at a regional level for Europe, Asia, North America and the U.K. For more information about the methodology, click here.

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient, operate more efficiently and effectively, gain competitive advantage, boost profitability and increase shareholder value. Fresh thinking, innovative products, unrivaled domain expertise, smart, passionate people — this is how GEP SOFTWARE™, GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale, power and effectiveness. Our customers are the world’s best companies, including more than 1,000 Fortune 500 and Global 2000 industry leaders who rely on GEP to meet ambitious strategic, financial and operational goals. A leader in multiple Gartner Magic Quadrants, GEP’s cloud-native software and digital business platforms consistently win awards and recognition from industry analysts, research firms and media outlets, including Gartner, Forrester, IDC, ISG, and Spend Matters. GEP is also regularly ranked a top procurement and supply chain consulting and strategy firm, and a leading managed services provider by ALM, Everest Group, NelsonHall, IDC, ISG and HFS, among others. Headquartered in Clark, New Jersey, GEP has offices and operations centers across Europe, Asia, Africa and the Americas. To learn more, visit www.gep.com.

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world. We are widely sought after by many of the world’s leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world’s leading organizations plan for tomorrow, today.

Media Contacts

| Derek Creevey Director, Public Relations GEP Phone: +1 732-382-6565 Email: derek.creevey@gep.com | Joe Hayes Principal Economist S&P Global Market Intelligence Phone: +44-1344-328-099 Email: joe.hayes@spglobal.com | S&P Global Market Intelligence Email: Press.mi@spglobal.com |

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to S&P Global and/or its affiliates. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without S&P Global’s prior consent. S&P Global shall not have any liability, duty or obligation for or relating to the content or information (“Data”) contained herein, any errors, inaccuracies, omissions or delays in the Data, or for any actions taken in reliance thereon. In no event shall S&P Global be liable for any special, incidental, or consequential damages, arising out of the use of the Data. Purchasing Managers’ Index™ and PMI® are either trade marks or registered trade marks of S&P Global Inc or licensed to S&P Global Inc and/or its affiliates.

This Content was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content.

Media contact

Breadcrumb

- HOME

- NEWS AND UPDATES

- FACTORY DEMAND WEAKENS ACROSS MAJOR ECONOMIES IN OCTOBER: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX