Accounts Payable Vs Accounts Receivable: Key Differences and The Power of Automation

- Accounts Payable (AP) and Accounts Receivable (AR) are two sides of the same coin, representing money owed by and to a company.

- AP is a liability, while AR is an asset, and both benefit from automation, which increases efficiency, reduces errors, and improves cash flow.

- Integrating AP and AR processes provides valuable data insights, enhances financial operations, and boosts liquidity management.

November 16, 2024 | Accounts Payable

Procurement leaders are increasingly leveraging the power of automation to get their accounts payable (AP) and accounts receivables (AR) right – driving efficiency and savings.

So, what is the difference between accounts receivable and accounts payable? They are two sides of the same coin.

Accounts payable is an account on your company’s general ledger that represents an obligation to pay off a debt to creditors or suppliers. In short, it’s the money owed by your business to third parties. On the other hand, accounts receivable refers to outstanding invoices owed to your company by customers. It represents a line of credit extended from the client to the customer.

Accounts receivable counts as a current asset while accounts payable counts as a current liability. This happens because accounts receivable will turn into cash within a year. On the other hand, accounts payable counts as a current liability because it represents money you owe to creditors.

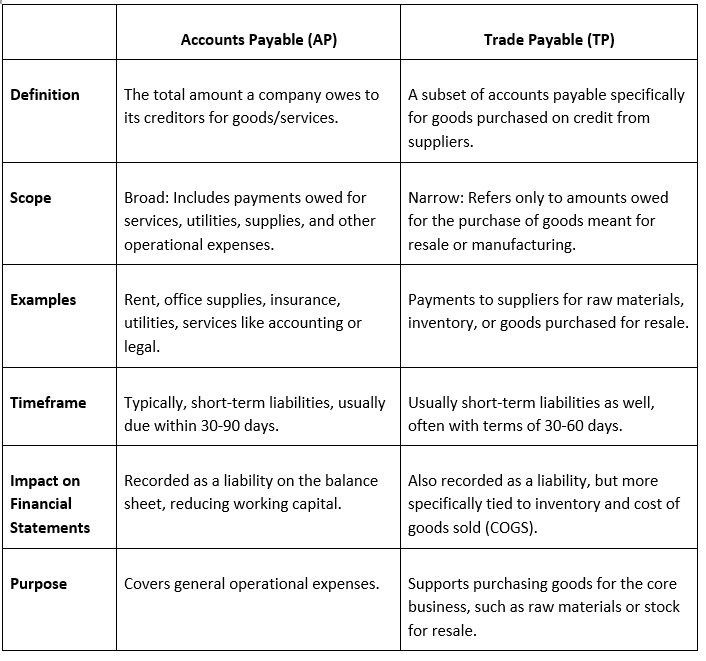

The following table succinctly describes the differences between AP and AR.

Why Are Accounts Payable and Receivable Important?

They are important because late payments can cause severe cash flow problems – leading to working capital getting tied up on your balance sheet.

And late payments are more common than one would imagine.

A staggering 73% of businesses of small and medium businesses are negatively impacted by late invoices. Late payments cost small businesses £22,000 a year on average in the UK, according to the Department for Business and Trade (DBT) and research by the Federation of Small Businesses.

Automation's Impact on Accounts Payable and Receivable

Automation most notably increases efficiency for accounts payable processes. It does so by eliminating manual tasks like invoice capture matching and validation.

This will allow organizations to conduct invoice processing quicker, and with higher accuracy. This optimized process significantly reduces late payments which brings about better supplier relationships – allowing businesses to capitalize on early payment discounts.

Automation also enables the detection and prevention of fraud through AI and ML technologies. They can instantly flag suspicious transactions and discrepancies in real time — providing organizations with a superior level of control and security.

Automation brings a host of benefits to AR as well.

It speeds up the payment collection process by automatically generating and sending invoices. This streamlined approach strategically shortens days sales outstanding (DSO) and enhances cash flow. And when this happens – businesses gain quicker access to working capital.

There are some obvious benefits of automation in AR as well. For instance, it minimizes manual errors in invoicing, credit application and reconciliation.

This reduces the likelihood of disputes and therefore allows faster resolutions when they do occur.

Whilst saving time it also improves customer satisfaction.

Additionally, users can also get self-service portals with automation tools to easily view and pay their invoices – resulting in a more positive overall customer experience.

Also Read: What's Wrong With Today's Accounts Payable and How to Fix it

The Synergy Between AP and AR

The true potential of automation can only be unlocked when there is a synergy between AP and AR processes.

When these two critical components are integrated you can gain seamless, data-driven insights.

With these data, you can optimize financial operations on both ends of the spectrum. Real-time analytics allow businesses to track payment trends, assess performance, and make strategic decisions with regards to cash management. Also, predictive insights into future cash flow and capital needs allow for better financial planning.

When both AP and AR processes are automated, you can achieve improved liquidity management, lower operational costs and greater transparency across the entire financial cycle.

This not only reduces risks but also enhances compliance – ensuring smooth and efficient financial operations that drive business growth.

Optimize Your AP and AR

Procurement leaders now are increasingly using automation to enhance accounts payable (AP) and accounts receivable (AR) processes.

Automation in AP reduces manual tasks, speeds up invoice processing and minimizes late payments.

While in AR, accelerates payment collections and reduces errors.

When integrated, automated AP and AR provide valuable data insights, improve financial operations and boost liquidity management.