Why You Should Consider Economic Order Quantity for Inventory Management

- Businesses are exploring different ways to efficiently manage inventory in an uncertain environment.

- While they want to maintain optimum levels of inventory, they cannot let costs go out of hand.

- Economic order quantity can help a business determine when to reorder inventory and how much to reorder.

March 28, 2023 | Inventory Management 3 minutes read

Growing economic uncertainty has compelled businesses to stock more inventory than they would normally do. In fact, many businesses plan to replace just-in-time with just-in-case inventory strategy to adapt to the changing business landscape.

This also means that they are now investing more money in inventory and warehouse operations.

The question now is: How long will they continue to stock excess inventory and incur additional costs? Do they have an alternative strategy to maintain optimum inventory and keep costs in check?

Let’s find out.

What is Economic Order Quantity?

The unforeseen events and supply chain disruptions in recent years have highlighted the importance of maintaining optimum levels of inventory. How can a business determine this optimum level of inventory and avoid additional costs involved in maintaining a buffer stock?

To minimize costs associated with surplus inventory, they determine the economic order quantity (EOQ) by looking at their ideal order size.

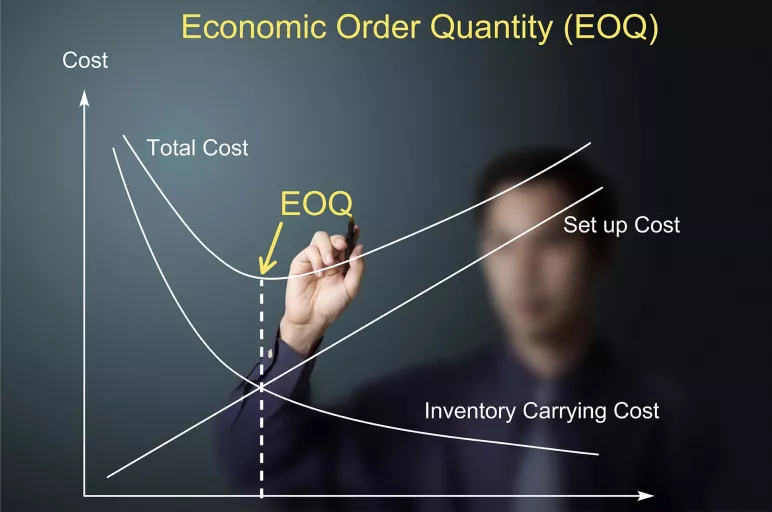

Ordering a large volume at one time increases holding costs, while ordering smaller batches at frequent intervals can lower holding costs but increase order costs. EOQ determines how much inventory to order to minimize the sum of these costs.

In other words, EOQ is the optimum order size that minimizes the total inventory cost.

As a mathematical tool, EOQ determines the number of units a business should add to the inventory with each order to minimize all costs related to inventory including order costs, holding costs as well as shortage costs.

It is calculated with the help of a formula that involves below variables:

EOQ= √2DS/H where

- D is the annual demand for product in units

- S is the ordering cost, and

- H is holding cost (per unit per year)

Why businesses use EOQ

EOQ is used as part of a larger process to monitor inventory levels at all times. It helps order a fixed quantity every time inventory reaches a specific reorder point. It helps to determine the appropriate reorder quantity (how much to reorder) as well as reorder time (when to reorder) to instantaneously replenish inventory and avoid shortages.

EOQ helps a business determine:

- How much inventory to keep on hand

- How many items to order

- When and how often to reorder to minimize inventory related costs

In addition to minimizing costs, EOQ helps a business avoid stockouts by quantifying how much it needs based on how much it sells in a given period of time. It also improves order fulfilment by ensuring that products are on hand to get the customer order out on time.

Limitations of EOQ

Simple as it may seem, the calculation of EOQ can be complex. A business may not have sufficient data for annual demand and other variables involved in the calculation. In such a situation, EOQ may not provide an accurate estimate.

EOQ does not consider fluctuations (and seasonal changes) in demand. It assumes that demand remains constant over a period. It is therefore not an appropriate model for a business that is expected to grow quickly.

Additionally, many a times, suppliers offer quantity discounts when a business orders in bulk or above a certain order size. The incentive here is to place a larger order to avail the discount. The EOQ model does not factor in these supplier discounts in the calculation.

Further, EOQ is calculated by assuming that ordering and holding costs remain constant. These costs may change because of market conditions and affect the calculation.

EOQ also assumes that inventory depletes at a fixed rate until it reaches zero when a specific number of items is added to it. The real-world inventory situation may be very different for a business.

Conclusion

EOQ can be a useful tool for businesses that need help to decide how much inventory to keep on hand, how much to order and how often to reorder. For large businesses that have high inventory ordering and holding costs, EOQ can improve cash flow and boost profits.

Today, businesses are streamlining inventory management by leveraging inventory management technology. Powered by artificial intelligence, advanced inventory management software can provide real-time data for better inventory visibility and accurate forecasting. It can also automate stock replenishment and help track crucial metrics such as inventory turnover.