Cash Flow Conundrums: How Purchase Order Financing Can Save the Day

- Shortage of working capital makes it difficult for small businesses to fulfil customer orders.

- Purchase order financing allows a business to access required funds and take on customer orders.

- It can be easier for a business to qualify for purchase order financing than other types of business funding.

May 29, 2023 | Procurement Strategy

Often, businesses get a large order but don’t have the operating capital to fulfil the order. It may be a dream order from a big client that simply cannot be declined.

Saying no to the client may hurt your long-term relationship. And your suppliers must be paid upfront to get necessary supplies and process the order.

What’s your best option then?

Here is when a funding solution can help your business.

What is Purchase Order Financing?

Purchase order financing is a funding scheme that allows a business to access funds against a verified purchase order and meet working capital requirements. In this scheme, a lender checks the purchase order as well as past records of supplies made to the buyer.

Purchase order financing can be considered as a short-term pre-shipment loan offered to the seller against a confirmed purchase order from the buyer. It is especially designed for small and medium enterprises that often find it difficult to raise funds. Such a scheme allows these enterprises to secure required funds, pay advance deposits to suppliers and accelerate production.

Typically, the lender looks at the purchase order and agrees to fund a percentage of supplier costs. In some cases, the lender may agree to pay up to 100% of the costs. For the borrower, the return is much higher than the financing fees paid to fulfil the order.

Also read: Blanket Purchase Order Guide: What Is It, When To Use and Its Pros and Cons

How Does Purchase Order Financing Work

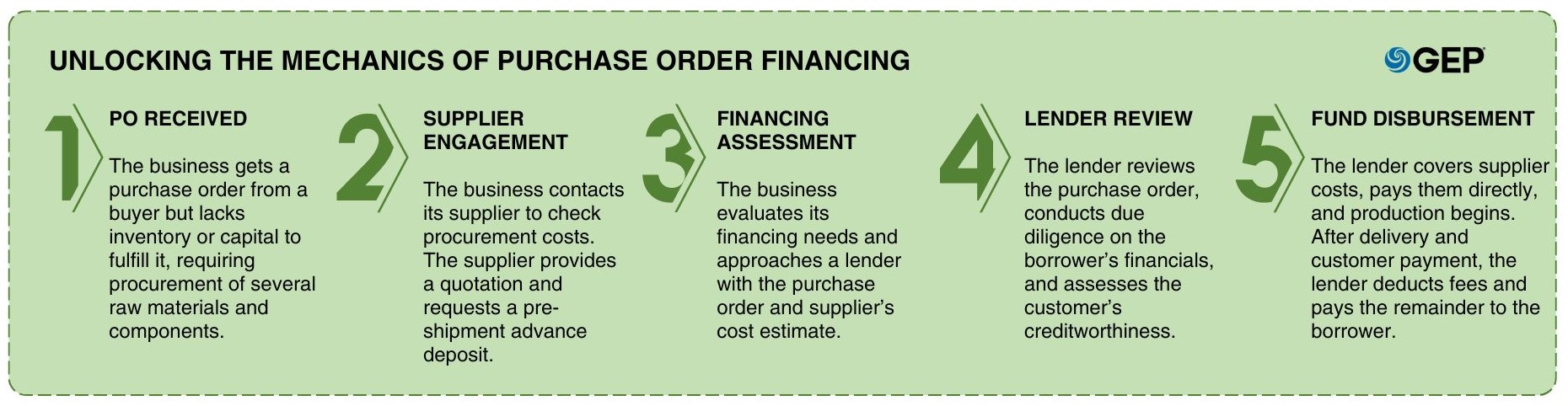

Here are the steps involved in this financing scheme:

- The business gets a purchase order from a buyer but doesn’t have inventory or capital to fulfil it. If the order is big, it requires the business to procure several raw materials and components.

- The business reaches out to its supplier and checks procurement costs. The supplier provides a quotation and asks for a pre-shipment advance deposit.

- The business assesses the need for financing and reaches out to a lender with the purchase order and supplier’s cost estimate.

- The lender reviews the purchase order and conducts due diligence on the borrower’s financials and customer’s creditworthiness.

- The lender approves a percentage of supplier costs and pays the supplier directly. Often, a lender pays suppliers with a letter of credit that guarantees payment when certain conditions are met.

- The borrower gets the supplies from the supplier and commences production to fulfil the order.

- When the customer receives the goods, they are sent an invoice and pay the financing company directly.

- The lender deducts its fees and pays the remaining amount to the borrower.

Pros and Cons of Purchase Order Financing

Compared to other types of business funding, purchase order financing can be easier to access. While evaluating the application, a lender is likely to focus more on your customer’s creditworthiness and the reputation of your suppliers.

Unlike a loan, purchase order financing doesn’t require the borrower to pay back funds in monthly installments. It is therefore an ideal way to secure funds and fulfil a customer order that may generate significant revenue. It can also help small businesses expand their customer base and regional footprint.

The drawback with purchase order financing is that it can be expensive. The borrower may initially research different financing companies and find their fees competitive – typically ranging between 1% and 6% of the total supplier’s costs per month.

While the fees may seem competitive, it isn’t a true indicator of the financing cost. It is important for the borrower to calculate the annual percentage rates that can range above 20%.

Additionally, the fees you have to pay is based on how long the customer takes to pay their invoice. The longer a customer takes to pay the invoice, the higher is the fees. This makes it difficult to estimate the total cost of financing upfront. Also, you have to rely on your customer’s creditworthiness to qualify for the financing.

Learn how GEP can help your organization effectively track purchase orders.