Battery Recycling: The Next Big Thing in the Global EV Market

- The growing popularity of electric vehicles has created growth opportunities for players in the battery recycling space.

- Battery recycling can reduce dependence on environmentally intensive mining activity for battery production.

- Slow pace of electric vehicle adoption and limited supply of batteries can hamper the growth of the battery recycling market.

May 29, 2023 | Automotives 4 minutes read

The global adoption of electric vehicles is growing at a rapid pace, leading to an increase in demand for electric vehicle (EV) batteries.

Yet, a significant number of these batteries are expected to approach end-of-life in the next decade.

What happens to these batteries when they reach end-of-life and can no longer be used?

Millions of electric vehicles are expected to be on the road over the next decade. Along with this, millions of tons of lithium-ion batteries are likely to reach the end of their working life during this period.

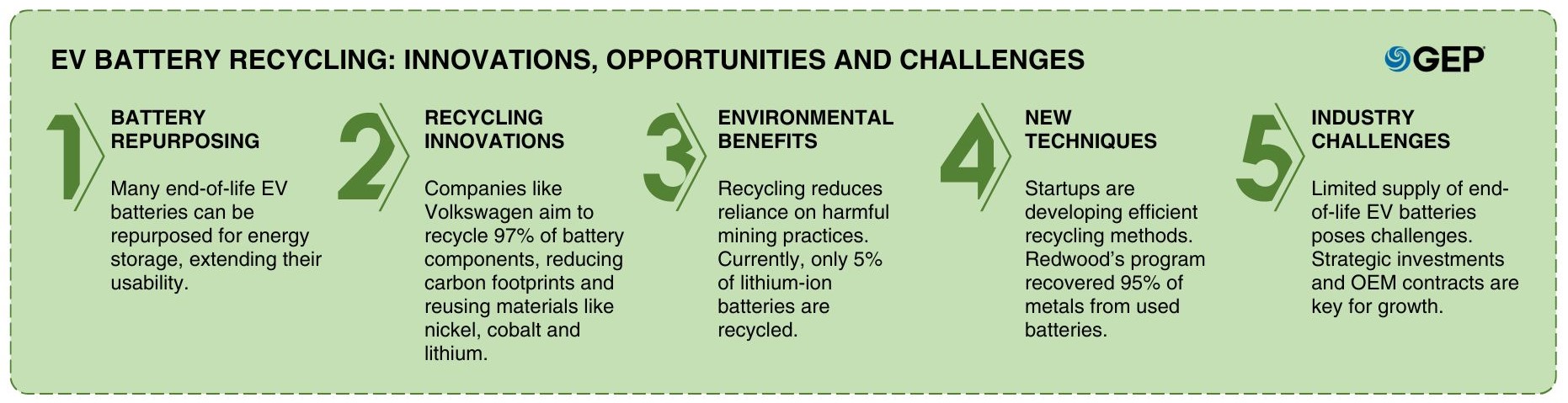

Interestingly, most batteries, after they are removed from an electric vehicle, can still be used for demanding jobs such as energy storage in the electricity network.

Electric vehicle manufacturers are researching how batteries can be repurposed after the end of their working life.

Volkswagen, for example, has set up a pilot plant for battery recycling in Salzgitter (Germany) that will look to recycle 97% of battery components. The company plans to create a circular, closed-loop process and reuse valuable raw materials such as nickel, manganese, cobalt and lithium in the manufacturing process.

Another key objective in this recycling process is to cut down the company’s carbon footprint. The company believes it can save more than one ton of CO2 per vehicle by producing batteries exclusively from recycled material.

Repurposing EV batteries can create a closed-loop system for recycling. This means that factories that manufacture batteries could eventually be powered using repurposed batteries.

Also Read: How EV Battery Makers Are Securing Graphite Supply Amid EV Rush

Emerging Opportunities in EV Battery Recycling

Electric vehicle battery recycling involves separating cobalt and lithium salts, stainless steel, copper, aluminum, plastic and other materials. In this process, individual battery parts are shredded, dried and then sieved to recover valuable materials. These materials can then be used in the production of new batteries.

Battery recycling can decrease the industry's dependence on environmentally intensive mining practices for battery production. Mining activities for battery raw materials are heavily concentrated in Russia, Indonesia and the Democratic Republic of Congo, with reports of environmental impact and poor labor standards.

Therefore, creating a circular supply chain by recycling battery materials will play a crucial role in reducing the environmental impact. Today, only 5% of lithium-ion batteries are recycled globally, leaving considerable opportunities for players in the global marketplace.

Additionally, battery recycling can also help to address the supply challenges of crucial raw materials such as lithium, cobalt, and others in the global market. With innovative techniques, valuable materials can be swiftly extracted from existing battery packs, and the chemistries can be modified to enable successful recycling and the production of new electric vehicles.

Several startups are commercializing cleaner and more efficient battery recycling techniques and building dedicated lithium-ion battery recycling factories in the global market.

In February 2022, Redwood launched the California EV Battery Recycling Program. It collected 1,268 end-of-life battery packs totaling around 500,000 pounds (227 tons) from 19 different BEV and hybrid models during the first 12 months of this program. Redwood was able to extract over 95% of the metals including lithium, cobalt, nickel, and copper from the used battery packs.

EV Battery Recycling: Revenue Model, Current Supply and Future Outlook

The current revenue model of the battery recycling industry relies on the sales of recovered raw materials. These revenues are influenced by factors such as the prices of raw materials, the mass content per battery and the recovery rate for each metal present in the battery.

Currently, automotive OEMs pay disposal companies to take scrap or end-of-life batteries, and ownership of the battery is entirely transferred. Battery recyclers are soon anticipated to transition toward a tolling model, wherein the recycler charges a fee for the battery recycling service, while the OEM retains control over the recovered raw materials.

The recycling capacity currently lags behind battery production because it takes years of operating an EV before its battery pack needs disposal, and electric vehicles are still a new mass-market trend. Due to this, recycling companies are getting most projects from the existing consumer electronics waste and the scrap from new battery manufacturing.

Despite the optimistic market opportunity, the battery recycling business is likely to face a daunting challenge due to the limited supply of EV batteries in the market in the coming years. Although there are other sources of batteries, such as hybrids and consumer electronics, the supply is limited, and collection can be challenging. This market scenario can create significant challenges for battery recycling companies.

Companies must make strategic investments in factories, machinery, and skilled workers to maintain a competitive edge. They must not invest too quickly though, for they could run out of money before aging batteries arrive at their loading docks. They should also look to secure contracts with automotive OEMs to access future volumes of end-of-life battery packs.

Despite the supply obstacles, battery recycling companies are likely to grow rapidly. The EV battery recycling market is likely to experience a moderate demand trend over the next half decade and can provide abundant growth opportunity in the global market.