Time for Sourcing to Wake Up to the Internet of Things (IoT) Opportunity

September 27, 2016 | Sourcing Strategy

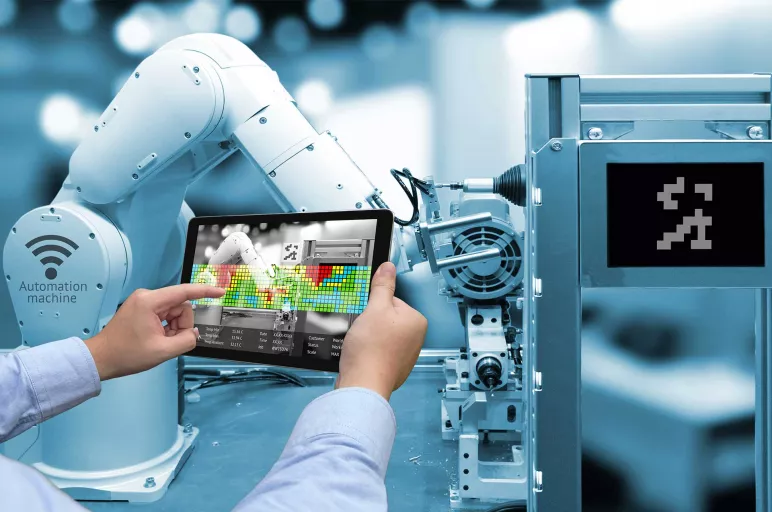

Unless one has been living under a rock for a while, chances are that the concept of ‘Internet of Things,’ commonly referred to as the IoT, is very familiar. Simply put, IoT is the network of physical objects that contain embedded technology enabling communication or interaction with their internal states and the external environment. IoT is translating the fevered imagination of science fiction novelists into hard reality as the examples of connected home, connected car, wearables, smart lights, and smart washers are materializing all around us.

Impacts of IoT will encompass multiple industries, enable new revenue streams and transform business processes. And, strategic sourcing units will need to develop an IoT sourcing strategy that helps calibrate their respective organizations for improved agility, transformation and outcome-based approaches.

Role of Sourcing in Enabling Internet of Things (IoT)

Cost optimization and the continuing zeal to search for and increase investments in new business models are driving the adoption of IoT, and will challenge sourcing managers to search for ways to integrate IoT endpoints and platforms with relevant technology systems. Additionally, the need for buyers to assemble IoT solutions from multiple solution providers due to the lack of dominant platforms within IoT will further challenge sourcing units trying to manage integrated delivery. The latter challenge will prove especially tantalizing for sourcing, as there may not be a dominant IoT platform till the end of 2018 (if leading analyst firms are to be believed) and buyers will have to continue sourcing solutions from across multiple providers.

Considering the proliferation of interest and initiatives in IoT, especially across the manufacturing and the retail sectors, it is concerning to not witness a level of interest and participation expected from the sourcing organizations. Holistic IoT initiatives will require active participation from sourcing in the preparation of a sourcing strategy, differentiation of service providers based on defined metrics and addressing security and risk issues.

Sourcing units are expected to be impacted by the IoT opportunity in multiple ways, and need to be prepared with suitable responses for the different scenarios:

-

IoT’s close adjacencies with traditional and emerging IT categories and the expected volume of connected assets and processes makes sourcing IoT solutions many times more complex than traditional IT. Unlike traditional IT sourcing managers who remain highly specialized and dedicated to specific sub-categories within IT (viz., hardware, software, services, telecom and networks), IoT sourcing will require buyers who are generalists and have a wider vision of the different portfolios within IT. IoT sourcing will require an understanding of not only the traditional IT categories, but also knowledge about emerging SMAC technologies, IoT end-points/connected devices and know-how on opportunities to generate new revenue streams in the respective sectors through transformed business models. Sourcing teams need to immediately start equipping themselves with the necessary knowledge of the IoT solutions market and the various issues (security, compliance) surrounding it. It wouldn’t be too impractical to witness specialized sourcing teams, especially within manufacturing and retail segments, aligned to the specific business units planning IoT initiatives.

-

Lack of dominant IoT platforms will pose significant challenges to the sourcing teams as they look to shortlist preferred partners from across multiple providers. Presently, no single provider has the end-to-end provisioning capability in IoT that requires multiple solution components that require further customization, integration and orchestration to make them relevant for enterprise use. Managing multi-vendor ecosystems will introduce complexities that sourcing teams may not have been very conversant with and will necessitate the introduction of new procurement practices. Sourcing organizations will need to build trusted relationships with credible knowledge service providers who can aid them in the preparation of competent IoT contracts and help select between commercial approaches suitable for IoT (fixed or transactional and outcome-based).

-

Cybersecurity and enterprise data transgression remain massive concerns and inhibit the smooth adoption of IoT. In such a scenario, the onus for reviewing cybersecurity policies and creating a preferred list of IoT providers to accommodate smooth adoption of IoT lies with sourcing. Increased competition in respective sectors will drive overzealous businesses towards rapid evaluation and adoption of IoT through shortening of procurement and sourcing cycles. In addition, the ongoing shift in IT budgets from IT to individual business units is encouraging vendors to bypass IT and directly engage with the business. These trends introduce significant challenges for sourcing executives to address cybersecurity and privacy related issues. Sourcing teams must collaborate with business and IT leadership to quickly formulate IoT adoption frameworks. They must also actively review guidance and compliance measures and engage with security and compliance teams to ensure that robust processes and guidelines are set internally before considering the IoT provider market. Sourcing teams must also create and share a list of approved IoT solution providers (who comply with the cybersecurity and risk norms) with the business and hence set protocols for final shortlisting. Incorporating data protection clauses in the agreement will remain a must!

Sourcing teams must realize that the Internet of Things opportunity isn’t just restricted to the business. Unless it has able support and the backing of the sourcing and procurement teams, an organization’s IoT endeavor is bound to remain incomplete.

Are there other ways/avenues in which your business is encouraging sourcing to participate in its IoT journey? Feel free to drop in a comment mentioning such moves or add your feedback!