Effective Supplier Relationship Management: Practical Strategies for the Chemical Industry

- Optimizing supplier relationships enhances compliance, performance, and operational efficiency.

- Strategic partnerships reduce costs, optimize processes, and boost overall competitiveness.

- Tailored SRM strategies ensure supply chain resilience and drive long-term value.

January 11, 2025 | Supplier Management Strategy

Effective supplier relationship management (SRM) in the chemical industry is essential to building strong and mutually beneficial partnerships that drive long-term success.

This approach not only improves compliance and performance but also strengthens operational efficiency. By fostering effective strategic supplier partnerships, organizations can reduce costs, optimize processes, and enhance overall competitiveness.

In this article, we outline practical strategies and proven methodologies GEP has used to help Fortune 500 companies in the chemical industry strengthen their supplier relationships and delivering an average of 5% to 6% incremental savings.

Chemical Industry Supplier Landscape

The chemical industry supplies a wide range of products, from basic commodities like methanol and ammonia to highly specialized chemicals used in pharmaceuticals and manufacturing.

This diverse landscape includes various types of suppliers — commodity chemical producers, specialty and fine chemical manufacturers, service providers and diversified suppliers.

This diverse landscape includes various types of suppliers — commodity chemical producers, specialty and fine chemical manufacturers, service providers and diversified suppliers.

Each supplier plays a distinct role in the supply chain and understanding how they fit into your company’s supply ecosystem is key to managing risks, optimizing spend and developing tailored SRM strategies.

Also, selecting the appropriate buying channels—whether directly from manufacturers and distributors or from alternative channels — further influences how companies manage supplier relationships and costs and ensure supply continuity.

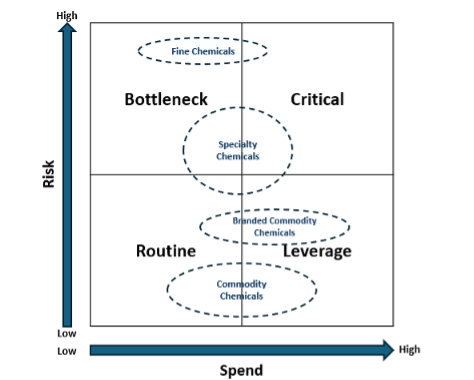

By categorizing suppliers and channels according to risk and strategic importance, procurement teams can prioritize high-impact suppliers, tailor relationship management strategies and ensure supply chain resilience, driving long-term value.

While segmentation of specific chemicals will differ by industry and company, the Kraljic Matrix (shown above) categorizes suppliers based on a typical business risk and spend profiles allowing us to better understand the strategic importance of each supplier type by group.

Supplier Segmentation by Product Type

Product Type | Typical Risk | Typical Spend | Typical Supplier Quadrant | Explanation |

|---|---|---|---|---|

| Commodity Chemicals | Low Risk | High Spend | Routine or Leverage Items | Commodities like methanol, ammonia, and ethylene are widely available, but due to high volume purchases, spend is significant. |

| Branded Commodity Chemicals | Low to Moderate Risk | Moderate to High Spend | Leverage Items | While still relatively standardized, branded commodities like fertilizers and polyethylene have some differentiation, so they carry slightly higher risk but still allow for negotiating power due to high spend. |

| Specialty Chemicals | High Risk | Moderate Spend | Bottleneck or Strategic Items | Specialty chemicals are critical to specific applications (e.g., adhesives, coatings), and disruption can severely impact operations, making them high-risk. Depending on the volumes, spend can also be high. |

| Fine Chemicals | High Risk | Low to Moderate Spend | Bottleneck Items | Fine chemicals like APIs and pharmaceutical intermediates are often purchased in smaller volumes, but they are critical to production and have limited suppliers, making them high-risk. |

Supplier Segmentation by Buying Channels

Supplier Segmentation | Product Type | Common Buying Channel | Business Scenario | SRM Approach | Alternative Buying Channels |

|---|---|---|---|---|---|

| Strategic | Specialty Chemicals | Directly from Manufacturer | A pharma company faces challenges developing a custom-engineered adhesive for a new medical device. | Form a strategic partnership with the manufacturer for joint development and ensure consistent supply. | Distributor, Contract Manufacturing (Toll) |

| Leverage | Branded Commodity Chemicals | Directly from Manufacturer | A plastics manufacturer is facing price fluctuations for paint resins, leading to increased production costs. | Negotiate bulk contracts to manage costs and ensure price stability for the long term. | Distributor |

| Bottleneck | Fine Chemicals | Directly from Manufacturer | A biotech company faces potential delays in clinical trials due to inconsistent supply of a high-purity enzyme. | Secure long-term agreements to ensure supply continuity, focus on quality assurance, and implement backup sourcing options. | Contract manufacturing, third-party agents, regularly looking at qualifying new sources as the business demands |

| Routine | Commodity Chemicals | Distributor | A facilities management company faces challenges in managing multiple suppliers for basic cleaning chemicals. | Consolidate suppliers, automate procurement, and do reverse auctions to streamline processes and reduce management overhead. | Online Marketplaces |

Case Study: A Medical Device Manufacturer in North America Achieved 50% Cost Savings

In this case study, GEP helped the client secure stable supply and mitigate risk from methanol price volatility.

Our Approach

- Market Intelligence: We used internal market data to highlight pricing misalignment and identified opportunities for cost reduction.

- Supplier Recommendations: A pool of alternative suppliers was identified.

- Competitive Pricing Discovery: Through an RFQ process, we found potential savings of 50%.

- Negotiation: We supported negotiations with the incumbent supplier, resulting in a 50% price reduction.

- Scenario Planning & Stakeholder Alignment: We developed multiple scenarios and facilitated alignment to ensure smooth project execution.

Outcome

- 50% cost savings

- Improved price transparency and protection against fluctuations

- Strengthened supplier relationships and long-term improvements

Tailored SRM Strategies

In the complex and dynamic chemical industry, tailoring SRM strategies based on supplier segmentation and buying channels is critical for success.

From strategic partnerships with specialty chemical manufacturers to leveraging distributors for commodity supplies, each scenario requires a unique approach to manage risk, optimize costs, and ensure continuity.

By aligning SRM practices with the specific needs of each supplier type — whether dealing with bottleneck items like fine chemicals or managing routine purchases through online marketplaces — companies can build stronger, more resilient supply chains.

By leveraging tailored SRM strategies across all supplier types and channels, businesses can not only mitigate risks and reduce costs but also unlock new opportunities for innovation and long-term growth.

To ensure successful SRM, organizations should prioritize accurate demand forecasting, build long-term relationships with strategic suppliers, and focus on dual sourcing to prevent supply disruptions.

Transparency in cost structures will enable more effective negotiations and partnering with suppliers that focus on sustainability can help companies meet future regulatory requirements by reducing carbon emissions and embracing circular economy principles.

Authors: Daniel Kim & Muktesh Nagar

Learn how GEP can help optimize your chemicals procurement and supply chain.