Why the Switchgear Market Is Facing Price & Supply Challenges

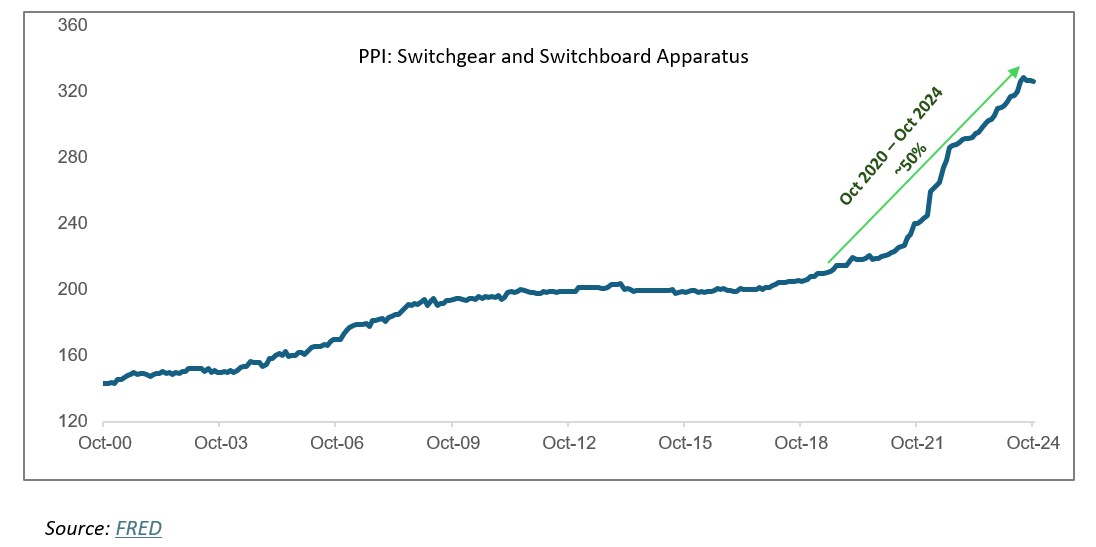

- Producer Price Index for switchgear has risen by nearly 50% since 2020

- Increased demand for renewable energy, aging infrastructure, and higher raw material costs are driving demand and price hikes.

- Manufacturers are expanding capacity to address supply constraints, but lead times remain above pre-COVID levels.

January 07, 2025 | Energy & Utilities

The global switchgear industry is struggling with rising pricing and longer lead times.

The post–COVID economic recovery has led to a surge in demand for switchgear, particularly in the power sector. Manufacturers, however, are struggling to meet the demand because of persistent supply chain disruptions.

Price Trends in the Switchgear Market

Growing investment in renewable energy, advances in technology, increase in raw material prices and project backlog are also fueling switchgear price rise.

Producer Price Index for switchgear has risen by nearly 50% between 2020 and 2024.

Let’s deep dive into these pricing pressures.

1. Suppliers Unable to Meet the Jump in Demand:

In North America, the demand for switchgear is driven by efforts to modernize the grid to support renewable energy and electric vehicle charging infrastructure.

In the United States, infrastructure investments are projected to be substantial, with the Department of Energy allocating around $46 billion for grid upgrades and energy efficiency initiatives in 2024.

In Europe, the demand for switchgear is driven by the focus on deploying renewable energy, with the European Union targeting a 45% share of renewables by 2030.

In China and India, the demand for switchgear has surged, especially in the power sector.

At the same time, there are significant capacity constraints, evident from expansion plans announced by major original equipment manufacturers.

However, these planned additions might take a few years to become fully operational.

2. Raw Material Prices Continue to Impact Switchgear Market:

Prices for switchgear are also influenced by supply-side constraints of raw material, mainly copper, which is also in high demand from sectors like electric vehicles and renewable energy.

Copper prices have increased by over 66% from 2020 to 2023, leading to increased production costs for switchgear. This trend continued in 2024 with copper prices increasing by 10% since the beginning of 2024 and price volatility continues to be a major challenge in the copper market.

Also Read: How to Stay Prepared for Copper Shortage

3. Switchgear Makers Charging a Premium Amid Higher R&D Cost:

The focus on advanced and sustainable solutions, along with the integration of digital technologies for improved efficiency and monitoring, is further increasing cost of switchgear, as manufacturers invest in R&D for smarter switchgear systems. A key trend is the creation of smart and eco-friendly switchgear solutions essential for standing out in a competitive market. For example, Schneider Electric has launched SF6-free medium-voltage switchgear, while ABB has introduced its AirPlus™ gas mixture as a sustainable alternative for gas-insulated switchgear (GIS).

Longer Lead Times and Backlog

Lead times for switchgear vary by region and are influenced by national policies.

In Europe, local supply chains lead to shorter lead times while the lack of a supplier ecosystem in the U.S. results in significantly longer delays.

The switchgear market has been impacted due to international regulatory challenges such as the SF6 ban, along with the reasons mentioned in the above sections, which has led increase in lead times.

Although these lead times for MV switch gear market have improved to 26-32 weeks, it remains significantly above pre-COVID levels of 12-16 weeks, impacting utilities and infrastructure projects.

Efforts to optimize supply chains and increase production capacity are expected to reduce lead times to about 24 weeks by 2027. A similar trend is observed in the LV switchgear market with a significant increase in lead times.

OEMs Increasing Production Capacity To Meet Demand

Manufacturers are actively working to shorten lead times. For examples, Vertiv aims to double its manufacturing capacity by the end of 2025 to enhance their global power management operations.

Similarly, Schneider Electric is investing $140 million in 2024 to expand its U.S. manufacturing for custom electrical switchgear and medium-voltage products, addressing critical infrastructure needs and rising data center demands.

These expansions will enable manufacturers to better meet increasing demand in the global markets and reduce lead times for switchgear delivery, while also allowing them to more efficiently tackle existing backlogs.

Conclusion

With the expected increase in demand in the next few years along with supply side constraints, prices will remain high because of aging power infrastructure and grid modernization needs. The continued transition of utilities to SF6-free switchgear and premium charges due to technological innovations will keep the prices at elevated levels.

On the lead times front, although the market is not expected to reach pre-COVID levels, the situation could ease given the capacity additions by major players in the next few years.

Author: Anshuman Prakash