Growing Role of Oil & Gas Companies in Building Clean Energy Supply Chains

- The changing energy landscape has compelled oil and gas suppliers to seek out new high-growth markets.

- The expertise of players in the oil and gas value chain in areas such as engineering, construction, fabrication, and maintenance can be effectively transferred to the clean energy sector.

- Major oil and gas companies along the value chain have already established ambitious targets to integrate themselves into the clean energy supply chain.

November 22, 2024 | Oil and Gas

The energy landscape is rapidly shifting, and the impact is already visible across key value chains. As the world moves towards renewable energy and away from fossil fuels, there is a growing necessity for traditional oil and gas contractors to adapt to remain relevant.

Global renewable electricity generation is projected to exceed 17,000 TWh by 2030 , representing an increase of nearly 90% compared to 2023. Forecasts by the IEA also suggest that in 2025, renewables-based electricity generation will overtake coal-fired generation, marking a significant milestone.

A significant advantage for stakeholders in the oil and gas supply chain lies in their projected role as enablers of decarbonization. This role is expected to contribute to the reduction of emissions while simultaneously creating new, long-term business opportunities. The share of revenue from new energy businesses currently ranges in hundreds of millions of dollars.

However, it is expected to jump to single-digit billion-dollar figures by the end of the decade.

Blending of Clean Energy and O&G Supply Chains

The growing push for decarbonization from various stakeholders, including governments and investors, has accelerated the development of key segments such as offshore wind, geothermal energy, Carbon Capture, Utilization, and Storage (CCUS), and hydrogen. Many of the leading stakeholders view these segments as high-growth markets.

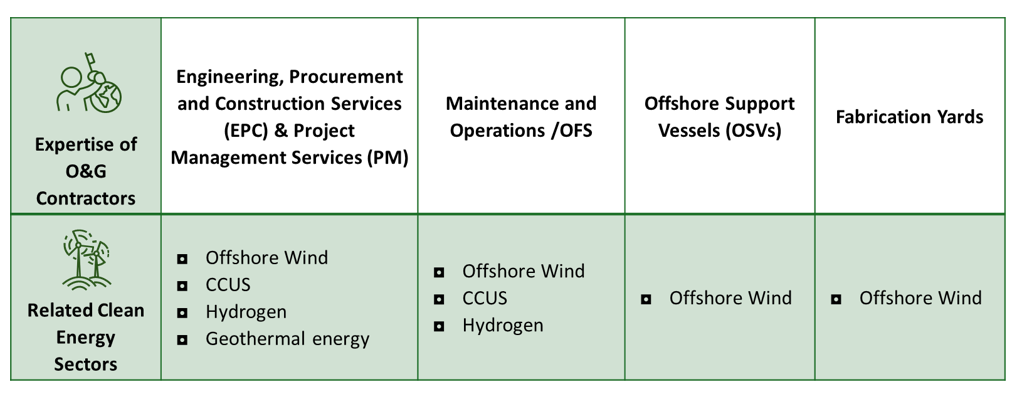

Certain expertise gained by oil and gas contractors over the years in drilling, offshore fabrication, and engineering services can be readily transferred to clean energy sectors, further lowering the entry barriers for this new space.

Different oil and gas value chain players are expected to solve a critical jigsaw puzzle, as illustrated in the table across various clean energy sectors.

The major oilfield services companies SLB, Baker Hughes and Halliburton already have “new energy” divisions that work on geothermal, hydrogen, carbon capture and storage (CCS), and direct air capture technologies and projects.

Major contractors are reporting significant contract wins and increased revenue share from these sectors. A key example is Baker Hughes, whose new energy orders totaled $750 million, reflecting a 45% year-over-year increase at the end of FY 2023.

While the U.S.-based EPC contractor Flour reported that 65% of its revenue in 2023 came from outside its traditional oil and gas market

Major yards are already reporting strong order intake from offshore wind, with new installation vessels entering the market to support this offshore sector.

The years 2023-24 also witnessed significant large contracts emphasizing how oil and gas are blending into this new energy mix.

A key example is TenneT, which awarded Petrofac and Hitachi Energy a multi-year Framework Agreement in 2023 as part of its plans to expand offshore wind capacity in the Dutch-German North Sea. This Framework Agreement, the largest in Petrofac's history, includes six projects.

Beyond these developments, other allied supply chains in the metals and steel market can also benefit from new demand arising from the new energy market, with major producers pivoting supply toward the renewable industry.

The steel industry will play a vital role in the upcoming acceleration of global offshore wind installations, with a potential demand for 4.5 million tons of steel generated from offshore auctions in 2023 alone among key players.

What's Next?

Contractors continue to strengthen their position in this new supply chain through various avenues, including mergers and acquisitions (M&A), research and development (R&D) investments, and partnerships.

Despite the possibility of another downturn cycle in oil and gas after 2025, oilfield service suppliers should be able to mitigate the downturn by expanding into other parts of the larger energy market, thereby broadening the overall target market for contractors.

According to SLB, its new energy division is estimated to reach around USD 3 billion by 2030 and is expected to grow to double digits by the end of the next decade.

Renewable energy technologies such as solar photovoltaics (PV) and onshore wind continue to reduce costs, making them competitive with traditional energy sources around the world.

Over the next decade, renewables will outcompete coal and gas in many global power markets in terms of cost.

A key example of this trend is solar; the levelized cost of energy (LCOE) has dropped by more than 90% since 2010 and is expected to decrease further. A similar trend is anticipated for other technologies such as offshore wind and hydrogen technologies.

Significant uncertainty about total demand regarding the potential of each clean energy alternative and the pace of adoption of renewable energy sources complicates companies' abilities to evaluate opportunities in their core markets.

Author: Chetan Chaudhari

Sources and references:

https://www.pv-tech.org/irena-solar-lcoe-falls-12-year-on-year-90-since-2010/